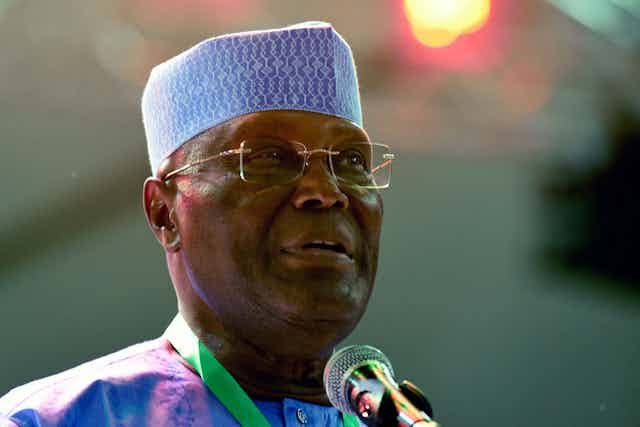

Former Vice President Atiku Abubakar has finally spoken out on the contentious tax reform bills proposed by President Bola Tinubu. Atiku’s statement comes on the heels of the National Economic Council’s (NEC) recommendation to withdraw the Tax Reforms Bill, which is currently before the National Assembly....TAP TO READ THE FULL CONTENT | TAP TO READ THE FULL CONTENT

In a statement released on Sunday, Atiku cited the need for a fiscal system that promotes justice, fairness, and equity. He noted that Nigerians are united in their call for a system that does not exacerbate the uneven development of the federating units.

Atiku also called for objectivity and transparency in the conduct of the public hearing being organized by the National Assembly. He stressed that transparency and objectivity are essential for promoting accountability, good governance, and public trust in policy-making.

The former Vice President urged the National Assembly to revisit and make public the resolutions of the National Economic Council, a key stakeholder and an important organ of the state with the constitutional power to advise the President concerning the economic affairs of the Federation.

His words, “I have followed the intense public discourse on the Tax Reform Bills with keen interest.

“Nigerians are united in their call for a fiscal system that promotes justice, fairness, and equity. They are loud and clear that the fiscal system we seek to promote must not exacerbate the uneven development of the federating units by enhancing the status of a few states while unduly penalising others.

“I call for objectivity and transparency in the conduct of the public hearing being organised by our representatives in the National Assembly. As a concerned stakeholder, I firmly believe that transparency and objectivity are essential for promoting accountability, good governance, and public trust in policy-making. The public hearing process must facilitate open and inclusive participation by all stakeholders, including Civil Society Organizations, traditional institutions, politicians, public officials, and subject matter experts.

“In this wise, I call on the NASS to revisit and make public the resolutions of the National Economic Council, a key stakeholder and an important organ of the state with the constitutional power to advise the President concerning the economic affairs of the Federation.

“The NASS must be appropriately guided and ensure that in the final analysis, the contents of the Bills align with the interests of the vast majority of Nigerians.”

The Senate recently passed the bills for second reading, despite opposition from some lawmakers. The bills have been referred to the Committee on Finance, which has been asked to revert in not more than six weeks.

The tax reform bills propose several key changes to Nigeria’s tax system, including an increase in Value Added Tax (VAT) from 7.5% to 10% by 2025. The bills also propose a 5% excise duty on telecommunications services and a 5% excise tax on lottery and gaming income.