Days after the new tax laws took off, Nigerians are decrying what they called double stamp duty charges by banks since January 1, 2026. DAILY POST reports that Nigerian banks began in January the collection of N50 stamp duties charged on senders of N10,000 and above..👉Read The Complete Original.

Consumers across financial institutions in Nigeria received emails from their banks, respectively, to effect the uniform N50 stamp duty charge as part of the new tax laws.

However, less than two weeks to the implementation, several Nigerians are crying out that their accounts have been overcharged.

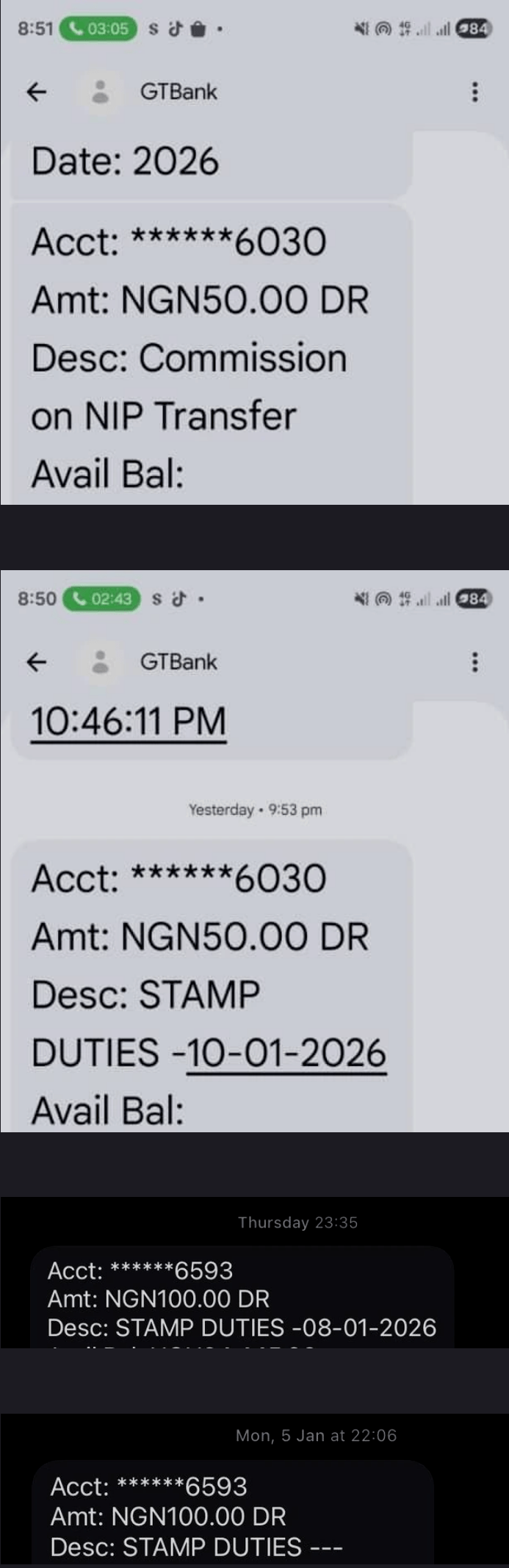

Several bank customers who spoke to DAILY POST in anonymity complained that they are being charged N100 per N10,000 transfer as opposed to N50.

“It is ridiculous that instead of charging N50 per N10,000 transfer, I was charged by my bank N100 for stamp duties last week despite the harsh economic realities we are faced with,” a popular commercial bank customer told DAILY POST.

Another customer threatened to take legal action against a Nigerian bank for multiple stamp duty deductions from his account.

“I will take necessary action or drag my bank online over multiple stamp duties charged.

“I was sent an email for N50, but they are collecting N100. Terrible,” he said.

Dr. Uju Ogunbunka, the president of the Bank Customers’ Association of Nigeria, did not respond to the DAILY POST call or text as of the time of filing this report.

Similarly, the Central Bank of Nigeria has not officially responded to the allegations of double stamp duty deductions by Nigerian banks.

Speaking with DAILY POST on Monday in an interview, a don at the Lead City University in Ibadan, Prof. Godwin Oyedokun, clarified that Nigerians must be careful not to misrepresent other banks’ deductions for stamp duty or the new tax laws.

He explained that he was debited a total of N100 for stamp duty and ‘NIP’ charges.

“Don’t let them deceive themselves. But don’t forget that banks at times may not charge you a minimum that they can control.

“They can consolidate it in the night and just charge you. So you just think that they charge you more than that. In fact, I’ve seen two hundred in my own case.

“But if you look at what you have done, you will see that you are not charged more than that. This is not about tax. And I don’t want people to use this to discredit the government.

“They say the commission on NIP transfer is N50 Naira, which is different from the N50 stamp duties,” he told DAILY POST..👉Read The Complete Original.

DAILY POST reports that from October 2024, when the Nigerian National Assembly received the tax laws, to June 2025, when President Bola Ahmed Tinubu signed them, to the present date, the tax reforms have been faced with multiple controversies.

The latest was the alleged errors and gaps spotted by KPMG; however, the Nigerian government dismissed doubts regarding the tax laws.

𝙍𝙚𝙖𝙙 𝙩𝙝𝙚 𝙇𝙖𝙩𝙚𝙨𝙩 𝙎𝙥𝙤𝙧𝙩 𝙏𝙧𝙚𝙣𝙙𝙨 𝙖𝙣𝙙 𝙂𝙚𝙩 𝙁𝙧𝙚𝙨𝙝 𝙪𝙥𝙙𝙖𝙩𝙚𝙨 𝙖𝙨 𝙩𝙝𝙚𝙮 𝙙𝙧𝙤𝙥 𝙫𝙞𝙖 [𝙏𝙬𝙞𝙩𝙩𝙚𝙧] 𝙓 𝙖𝙣𝙙 𝙁𝙖𝙘𝙚𝙗𝙤𝙤𝙠 Now.

Join Our WhatsApp Channel

To join: Simply click on the link below and turn on notifications to receive the latest scholarship, job, and opportunity updates instantly.

Join WhatsApp Channel